It is a daunting task for senior citizens to properly invest the capital raised on the maturing capital of a public provident fund or any other scheme. This task has become more difficult nowadays as banks have lower interest rates on fixed deposits. So there is confusion as to where to invest the money. Everyone wants interest to be good and money to be safe.

There are two great government schemes for senior citizens to invest their retirement money - Senior Citizen Savings Scheme (SCSS) and Pradhan Mantri Vay Vandana Yojana (PMVVY). What is special about both these schemes is that the investment made in them is secured by the government and the interest is paid more than the bank FD.

Senior Citizen Savings Scheme (SCSS)

The purpose of the Senior Citizen Savings Scheme (SCSS) is to provide regular income to senior citizens after retirement. SCSS account can be opened in public and private sector banks and post offices. The Senior Citizen Savings Scheme (SCSS) is designed for Indian residents over the age of 60 years. Deposits mature 5 years after the date of account opening. Maturity can be extended for a further 3 years at a time. The current interest rate for a senior citizen savings plan is 7.4% per annum. This interest rate is higher than the interest rate of bank FD and savings account.

You can earn up to Rs 1.5 lakh by investing in a Senior Citizen Savings Scheme under Section 80C of the Income Tax Act. You can get tax deduction every year. The process of investing in SCSS is quite simple. The amount of interest under SCSS is paid quarterly (every three months). Interest is credited to the account every April, July, October and the first day of January. A person in a senior citizen savings scheme has Rs. Less than 1,000 can start investing. A maximum of Rs 15 lakh can be invested in this.

Pradhan Mantri Vay Vandana Yojana (PMVVY)

Pradhan Mantri Vay Vandana Yojana (PMVVY) is a pension scheme. Under this scheme senior citizens aged 60 years and above can opt for monthly and annual pension. If they choose a monthly pension, they will get 8% interest for 10 years. If they choose the annual pension option, they will get 8.3% interest for 10 years. A maximum of Rs 15 lakh can be invested in this scheme. Based on the investment, senior citizens get Rs. 1000 to Rs. Pensions up to 9250 can be obtained.

Investment in Pradhan Mantri Vay Vandana Yojana can be done both online and offline. To invest in this scheme online, one has to visit the website of Life Insurance Corporation of India (LIC). Investment in Pradhan Mantri Vay Vandana Yojana can also be made by visiting the LIC branch. There is no tax exemption on investing in this scheme

રિટાયરમેન્ટ પર મળેલ પૈસાનું કરવું છે રોકાણ, તો પસંદ કરો આ બે યોજના; થશે ફાયદો

🏏 IPL 2022, DC vs PBKS

દિલ્લી કેપિટલ્સમાં કોરોનાના 5 કેસ નોંધાતા પંજાબ સામેની મેચને લઈ લેવાયો મોટો નિર્ણય

SOURCE BY ABP ASMITA

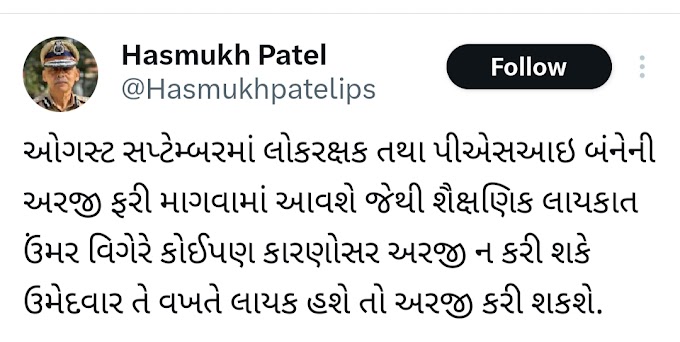

ગ્રામસેવક & મુખ્યસેવિકા પરીક્ષા ની તારીખ જાહેર