In times of financial crisis, we often look for options where we can get money easily and pay less interest. A popular option for this is a personal loan. Personal loans have no collateral, but the real problem is that they are expensive. Here we are telling you about another banking facility from where you can fulfill your money needs easily.

This facility is an overdraft facility of the bank.

Both government and private banks provide overdraft facilities. Most banks offer this facility on Current Account, Salary Account and Fixed Deposit (FD). Some banks also offer overdraft facility against assets like shares, bonds and insurance policies. Under this facility, you can withdraw the money you want from the bank and repay this money later.

How to avail overdraft facility

If you don't have any FD in the bank, you have to pledge any assets in the bank first. Banks then offer you an overdraft facility. Nowadays many banks already offer overdraft facility to their good customers. Salaried people easily get overdraft on it.

How much money can I take?

The bank decides how much money you can borrow under an overdraft. This limit depends on what you have pledged with the bank for this facility. Banks keep the limit higher in case of salary and FD. For example, if you deposit Rs. 2 lakhs FD, then for bank overdraft Rs. 1.60 lakh (80%) may fix the limit. The limit may be 40 to 70 percent in case of shares and debentures.

Interest rate

How much interest will be earned depends on the assets on which you have been given the overdraft facility. You have to pay interest according to the period for which you borrow money from the bank. This means that if you borrowed money on December 25 and paid on January 25, you would have to pay about a month's worth of interest. If you have availed this facility on FD, your interest rate remains 1 to 2 percent higher than the interest on FD. In case of other assets including shares, the interest rate may be slightly higher.

What are the benefits of overdraft?

It is much cheaper than in case of credit card or other personal loans. In this, you have to pay relatively less interest. Another advantage is that in an overdraft, you have to pay interest for the same amount of time you have borrowed the money.

What is a bank overdraft facility? Know how to take advantage of money when you need it

શું હોય છે બેંક ઓવરડ્રાફ્ટની સુવિધા? જાણો પૈસાની જરૂરત થતાં કેવી રીતે લઈ શકાય છે તેનો લાભ

Whatsappને પોતાની ભાષામાં કરી શકશો યૂઝ, લૉન્ચ થયુ App Language ફિચર

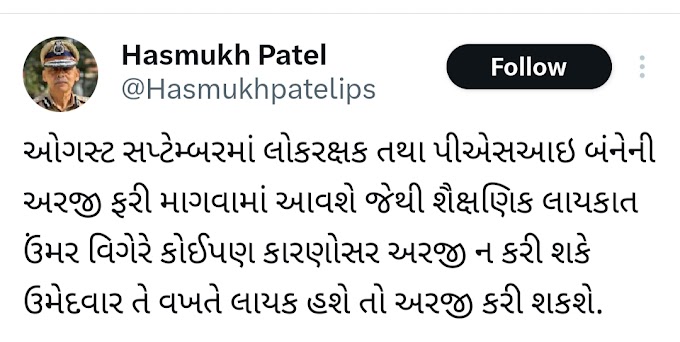

PSIની ૧૩૮૨ જગ્યાઓ માટે અંદાજીત પસંદગી યાદીનું કટઓફ જાહેર

વિકાસ સહાય સરે ટ્વીટ કરી આપી માહિતી

પો.સ.ઇ. કેડરની કુલ-૧૩૮૨ જગ્યાઓ સીધી ભરતીથી ભરવા માટે જાહેરાત ક્રમાંકઃ PSIRB/202021/1નું અંદાજીત પસંદગી યાદીનું કટઓફ જાહેર કરી દેવામાં આવ્યું છે