How do I start a mutual fund?

The simplest way of doing this is to fill up the form, attach a photograph, PAN card copy and a valid address proof, such as Aadhaar, passport copy, electricity bill or bank statements. This can be submitted along with the first investment form to a registrar or a mutual fund office.

Amid growing needs and changing lifestyles, it is only right to focus on safe investments. It is said that investment has no limit or time. Only when you start investing, is the right time.

You can start with 1000 rupees

If you are not able to save much even after lakhs of efforts, then we will tell you how you can make a large fund with small investments (Large Fund With Small Investment).

You can start it with just 1000 rupees.

Journey from 1000 rupees to becoming a millionaire

Here we will talk to you about investing in mutual funds. You can start your journey to becoming a millionaire even starting with a SIP of Rs 1000. Let us know how this is possible?

For that you will need to invest 1000 rupees every month in mutual fund. Over the past few years, some mutual funds have given investors returns of up to 20 percent or more.

On investing for 20 years

We told you in the beginning about depositing Rs 1000 per month. If you invest this amount for 20 years, you have accumulated a total of Rs 2.4 lakh during this period. In 20 years you will get around 15 lakh 16 thousand rupees based on 15 percent annual return. If this return is 20 percent per annum then the total fund would be around 31.61 lakhs.

On investment for 30 years

If you invest Rs 1000 every month for 25 years and get 20 percent annual return on it, you will get a total fund of Rs 86.27 lakh at maturity. In this way, if this period is increased to 30 years, then with a return of 20 percent, your fund of 2 crore 33 lakh 60 thousand will be ready.

Let us tell you that mutual fund investors get the benefit of compounding. Also, it has the facility to invest every month. This is the reason why you can expect to get a large fund on a small investment.

With awareness of mutual funds and digital outreach, asset management companies (AMCs) have added nearly 7 million investor accounts in the first five months of the current financial year, taking their total to 13.65 crore.

According to data from industry body Association of Mutual Funds in India (Amfi), 3.17 crore investor accounts were added in 2021-22 and 81 lakh investor accounts in 2020-21. The increasing number of mutual fund accounts shows that a large number of new investors are entering the capital market and choosing mutual funds for investment.

Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management, said, 'Demonetisation led to the monetization of household savings, which were exacerbated by the pandemic-induced lockdown. Also, systematic investment schemes have become a way of life due to major changes in saving and risk-taking patterns. Due to boom in the market, a large number of investors are investing in mutual funds.

According to the data, the number of investor accounts with 43 mutual fund companies has increased from 12.95 crore in March 2022 to an all-time high of 13.65 crore in August 2022. This means that 70 lakh new accounts have been added in this period. The accounts of 10 crore investors in the industry were completed in May 2021 itself.

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe and open-ended investment company in the UK

What are the 4 types of mutual funds?

Most mutual funds fall into one of four main categories – money market funds, bond funds, stock funds, and target date funds. Each type has different features, risks, and rewards

What mutual fund means?

A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.

Best Performing Equity Mutual Funds

Fund Name 3-year Return (%)* 5-year Return (%)*

ICICI Prudential Technology Direct Plan-Growth 30.23% 26.68%

Aditya Birla Sun Life Digital India Fund Direct-Growth 28.13% 26.08%

SBI Technology Opportunities Fund Direct-Growth 26.08% 24.77%

Quant Tax Plan Direct-Growth 42.54% 24.68%

Which type of mutual fund is best for beginners?

Performance Overview of the above-listed Mutual Fund for Beginners

1) Canara Robeco Equity Tax Saver Fund.

2) ICICI Prudential Equity & Debt Fund.

3) DSP Tax Saver Fund.

4) Mirae Asset Tax Saver Fund.

5) Kotak Tax Saver Fund.

6) Edelweiss Aggressive Hybrid Fund.

7) SBI Equity Hybrid Fund.

What are the benefits of mutual fund?

Advantages and Benefits of Investing in Mutual Funds in India

Liquidity. ...

Diversification. ...

Expert Management. ...

Flexibility to invest in Smaller Amounts. ...

Accessibility – Mutual Funds are Easy to Buy. ...

Schemes for Every Financial Goals. ...

Safety and Transparency. ...

How do I buy mutual funds directly?

You could invest in a Direct Plan online through the websites of the respective mutual funds or via online platforms of stock exchanges platform or Mutual Funds Utility (MFU) or other various digital channel. There are also a few online portals which offer a facility to invest in Direct Plans.

How much money do I need to start a mutual fund?

$1,000 to $5,000

Mutual funds require minimum investments of anywhere from $1,000 to $5,000, unlike stocks and ETFs where the minimum investment is one share. Mutual funds trade only once a day after the markets close. Stocks and ETFs can be traded at any point during the trading day.

How do I start a mutual fund?

The simplest way of doing this is to fill up the form, attach a photograph, PAN card copy and a valid address proof, such as Aadhaar, passport copy, electricity bill or bank statements. This can be submitted along with the first investment form to a registrar or a mutual fund office.

પરીક્ષા આયોજન ફાઈલ 2022-23

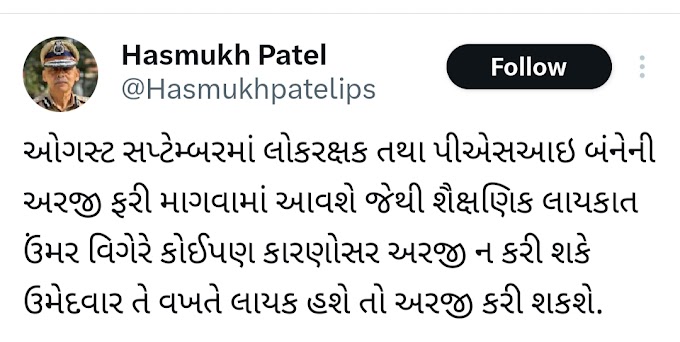

GUJARAT ROJGAR SAMACHAR

DATE 28-9-2022

મિનેશ

ReplyDelete